💎 Tampa art museum expands, luxury home sales boom, & interest rates drop

🎨 Tampa Museum of Art Secures Additional $10M for Riverfront Growth

Driving the news: The Tampa Museum of Art is set to receive a significant boost in its riverfront expansion efforts, with the Tampa City Council approving an additional $10 million in public funding.

This decision brings the total contribution from the Downtown Community Redevelopment Agency (CRA) to $24.75 million over ten years.

Details: The CRA, a state-designated area for urban renewal, redirects new or incremental tax revenue within its boundaries toward development projects.

The museum's expansion, initially estimated at $80 million, has now escalated to $110 million due to rising labor and material costs.

In 2021, the CRA had already pledged $14.75 million over five years for this project.

Why it matters: The additional funding will specifically support public elements of the expansion, such as outdoor sculpture plazas and enhanced accessibility between Poe Parking Garage and Gasparilla Plaza.

This aims to improve connectivity with Curtis Hixon Park and foster greater public engagement with the museum.

The big picture: The museum's expansion is seen as a significant investment in the city's cultural infrastructure, contributing to the urban landscape and local economy.

What’s next: The project will proceed with the new funding, focusing on enhancing public spaces and accessibility.

This move signals a strong commitment to cultural development in Tampa but also raises questions about balancing such investments with other civic priorities.

The bottom line: The Tampa Museum of Art's expansion reflects a growing trend in cities investing in cultural landmarks as a means of urban renewal and economic development.

While there is broad support for such initiatives, they often stir debates about resource allocation and municipal priorities in the face of diverse urban challenges.

💎 Luxury home sales surge in Tampa Bay

Driving the news: Luxury real estate is witnessing a significant boom in the Tampa Bay area, with sales of the region's most expensive homes up by a remarkable 36% in the third quarter of 2023.

This increase is the largest recorded in the country, according to a new report from Redfin.

Details: A significant portion of luxury buyers are opting to pay in cash, a strategy that provides more flexibility in terms of insurance and mortgage rates. This trend is particularly evident in Tampa Bay.

Luxury home listings in Tampa saw a 22.5% increase from last year, with the median luxury home price settling around $1.3 million.

In contrast, the non-luxury housing market experienced a decline in both supply and sales, with the median non-luxury home price at approximately $368,000.

Why it matters: Tampa Bay's luxury market surge is part of a broader national trend, with luxury sales up in nearly one-third of major U.S. metros. However, the rise in non-luxury home sales is lagging behind, down in every major U.S. metro.

Zoom in: Tampa Bay's luxury market is fueled partly by its relative affordability compared to northeastern states and California. New construction and aggressive marketing strategies, especially in luxury condos, are also key drivers of this trend.

What’s next: Tampa Bay's luxury real estate market continues to grow, with new developments like The Ritz-Carlton Residences attracting considerable interest.

These developments offer high-end amenities and are increasingly popular among local buyers who prefer condominium living for its convenience and additional services.

The bottom line: The surge in luxury home sales in Tampa Bay reflects a shift in buyer preferences and highlights the region's growing appeal due to its charm, amenities, and strong job market.

🏠 Mortgage rates have dropped below 7%

Driving the news: In a significant development for the housing market, mortgage rates have dipped below 7% for the first time since mid-August.

This marks the seventh consecutive week of declining rates, influenced by improving inflation figures and the Federal Reserve's pause in rate hikes.

Details: The 30-year fixed-rate mortgage averaged 6.95% in the week ending December 14, a slight decrease from the previous week's 7.03%, as reported by Freddie Mac.

This is a noteworthy shift from the 6.31% rate observed a year ago.

These figures are based on data collected from numerous lenders and reflect mortgages with a 20% down payment and excellent credit.

Mortgage applications have risen for six weeks straight, indicating growing borrower demand in response to the falling rates.

This trend is particularly significant for first-time buyers, who have struggled with affordability and low housing inventory.

Why it matters: This decline is critical for potential homebuyers who have been grappling with high rates and an unaffordable housing market.

Freddie Mac’s chief economist, Sam Khater, anticipates a gradual revival of the housing market in the coming year, particularly if inflation continues to slow and the Fed cuts rates as expected in 2024.

The big picture: The rates peaked at 7.79% in late October, making the current decline a sign of potential relief for prospective buyers.

The housing market, which has been experiencing its least affordable period since the 1980s, could see increased activity as rates continue to fall.

Between the lines: Despite the dip in rates, challenges remain due to the persistently low housing inventory.

Current mortgage holders, the majority of whom have rates below 6%, are hesitant to sell, leading to sustained low inventory and elevated prices.

What’s next: The Federal Reserve's recent decision to pause rate increases and the possibility of rate cuts in 2024 are pivotal factors influencing mortgage rates.

These actions, coupled with economic indicators like job growth and inflation rates, will continue to shape the housing market dynamics in the upcoming year.

The bottom line: While the drop in mortgage rates is a welcome development for potential buyers, the market faces ongoing challenges due to low inventory and the 'lock-in effect' of existing homeowners with low mortgage rates.

The upcoming year will likely see a continued focus on affordability and inventory levels as key drivers of the housing market.

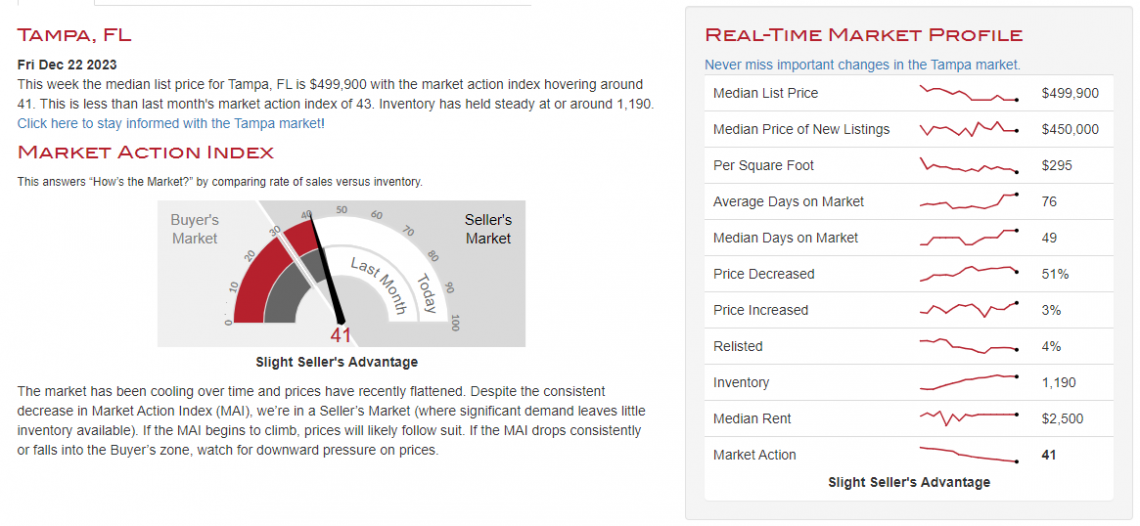

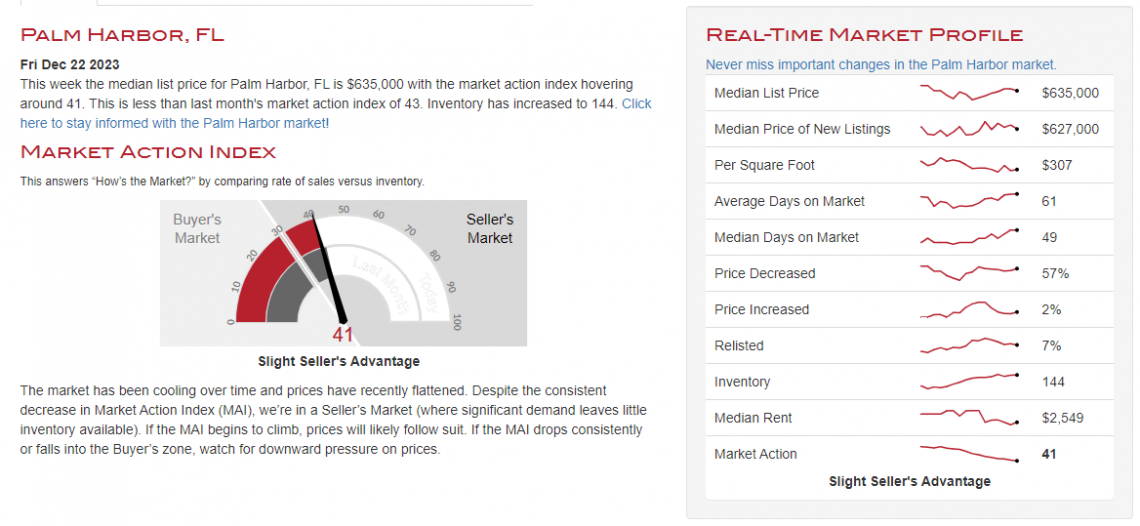

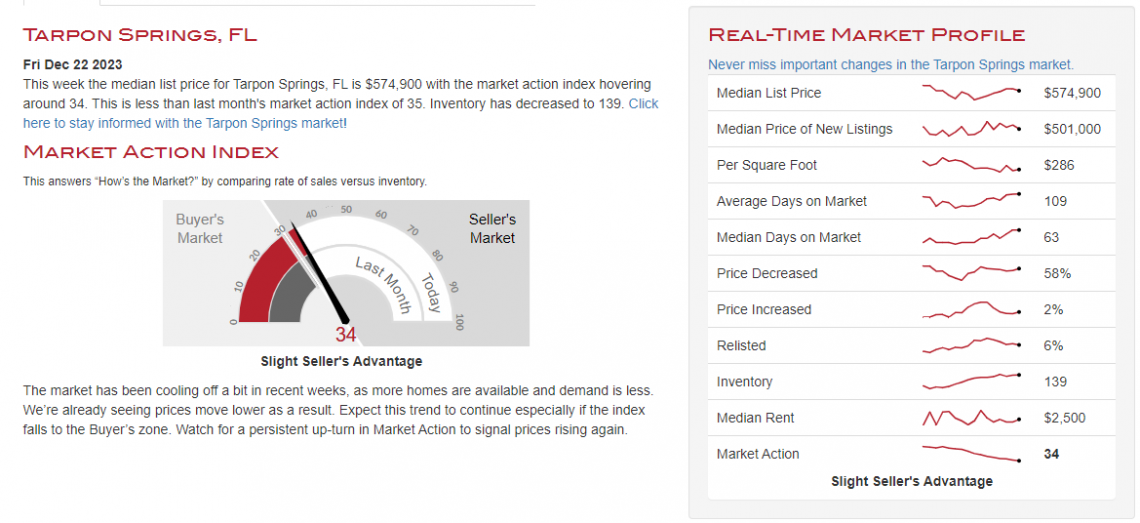

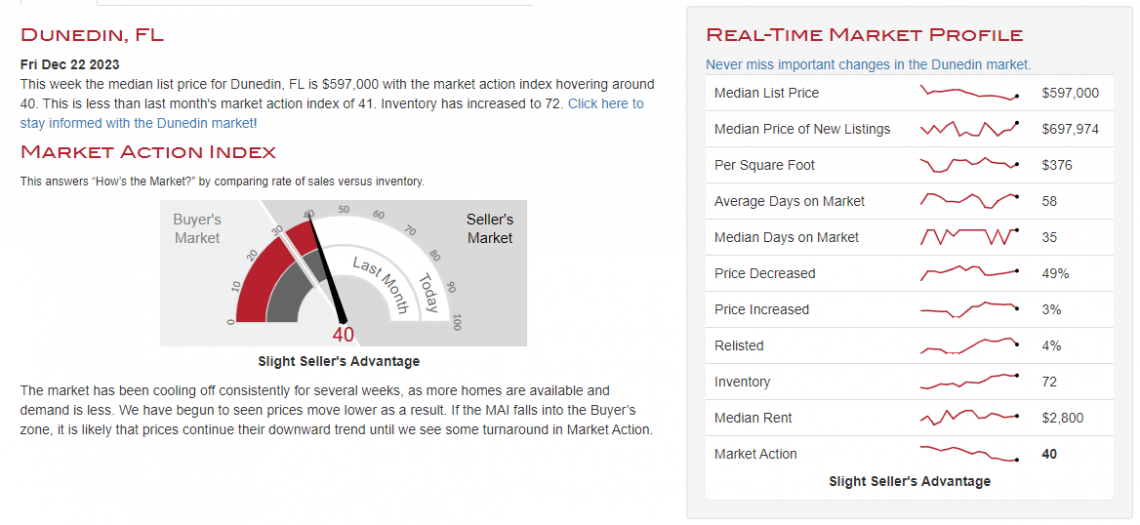

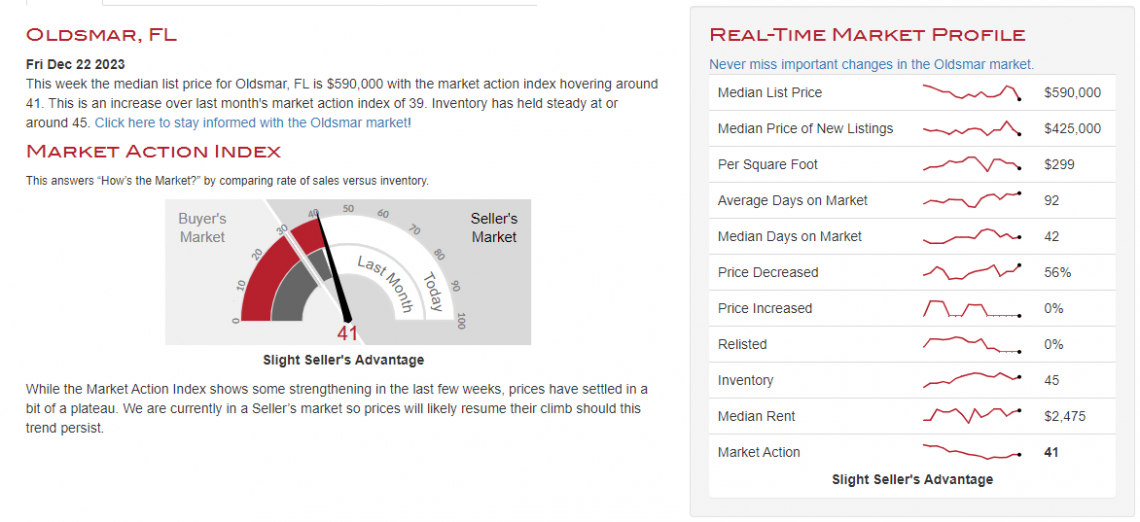

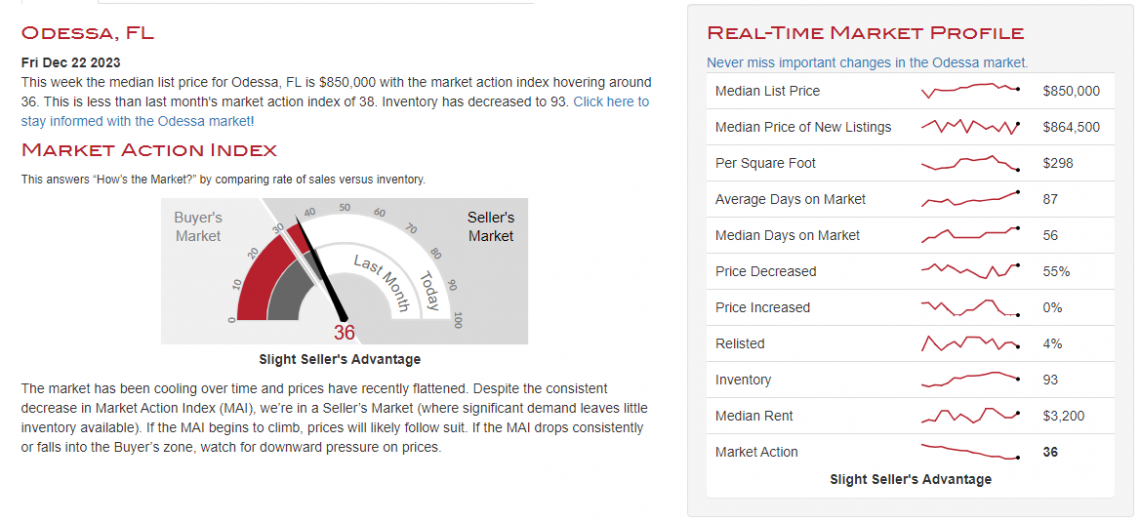

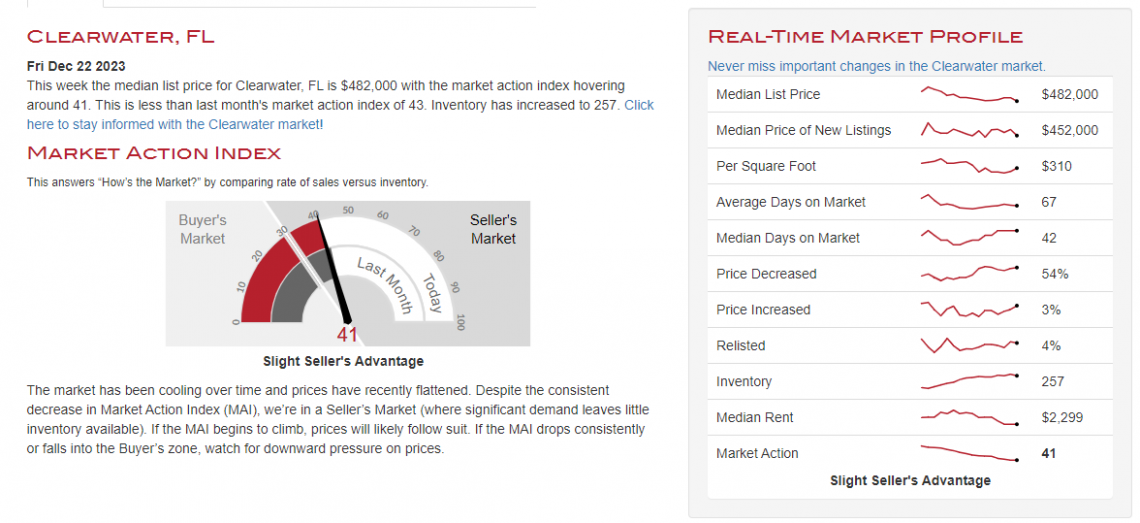

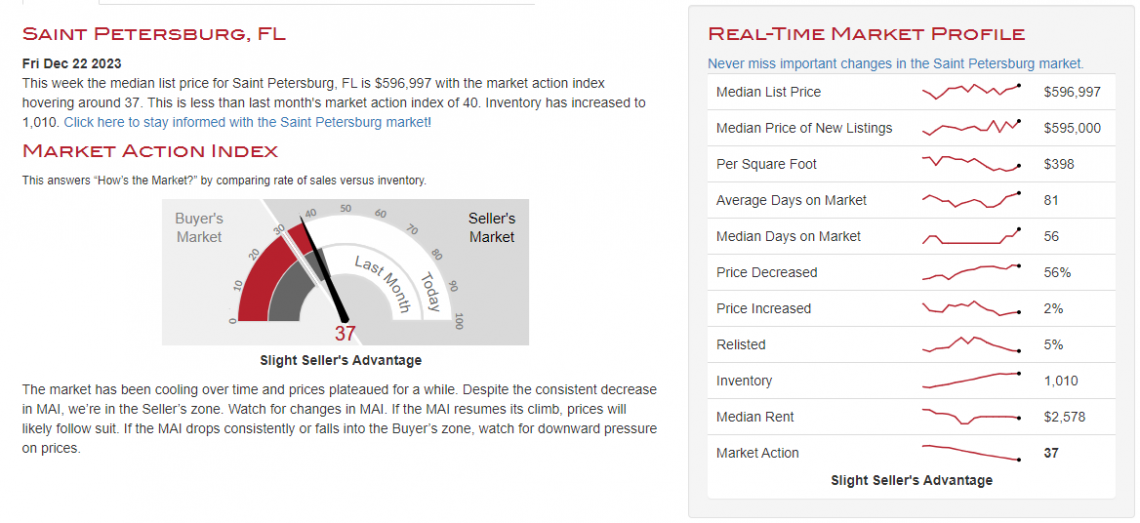

📊 Our Current Local Market Numbers

The Pinellas County housing market has very low inventory that is driving high competition:

➡️ Homes in Pinellas spent about 22 days on the market in June compared to 8 days in June of last year.

➡️ The median sale price of a home in Pinellas County was $392K in June, down 0.76% since June last year.

➡️ There were 1,807 homes sold in June this year, down from 1,952 last year.

The bottom line: Homes may be taking slightly longer to sell than last year, but we are still in a seller's market.

The higher interest rates have slowed things slightly, but also created very low inventory so competition among buyers remains high.

You’ll need a strong offer to purchase a home in these conditions.

We’re staying on top of the market daily and there are even financing options that help you purchase at a lower rate.

If you ever have questions, don’t hesitate to ask.

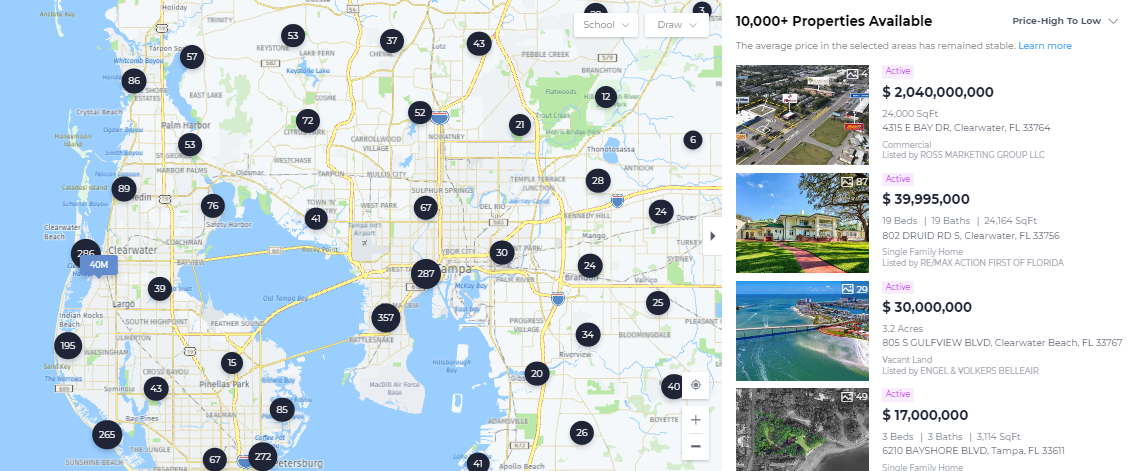

🏠 Find Available Homes Today

- Available Homes in Palm Harbor

- Available Homes in Tarpon Springs

- Available Homes in East Lake

- Available Homes in Odessa

- Available Homes in Westchase

- Available Homes in Oldsmar

- Available Homes in Safety Harbor

- Available Homes in Dunedin

- Available Homes in Clearwater

- Available Homes on the Beaches or Intercoastal

- Available Homes on a Golf Course

- All Available Homes

📰 In Other News:

- That’s all for today, We hope you have an amazing week!

If there’s ever anything you need:

- Custom market or home value report.

- Home Services list for a reliable contractor or services professional.

- Feedback or a professional opinion on a home project or other needs of the home.

Just let us know! We’re here to help with all your home needs.

Talk soon,